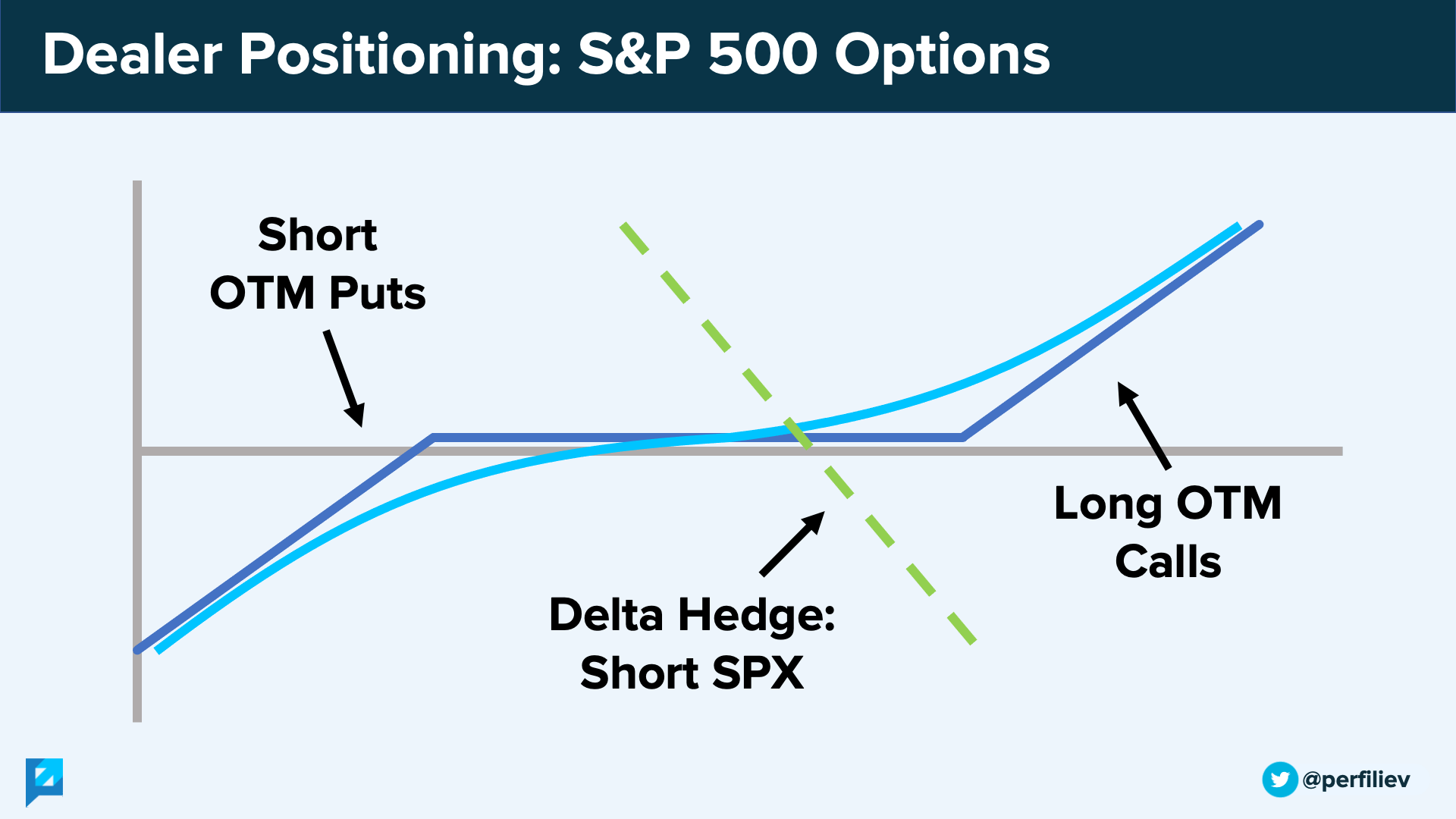

How Options are Impacting the Underlying Market (Gamma, Vanna and Charm Explained) - Perfiliev Financial Training

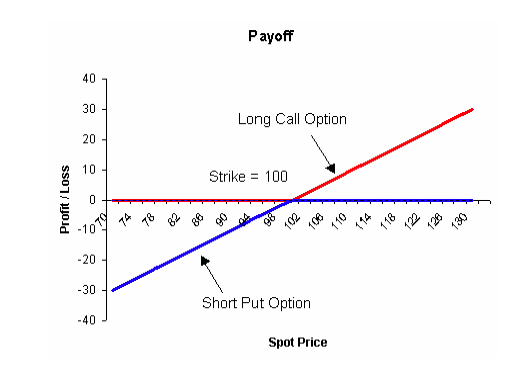

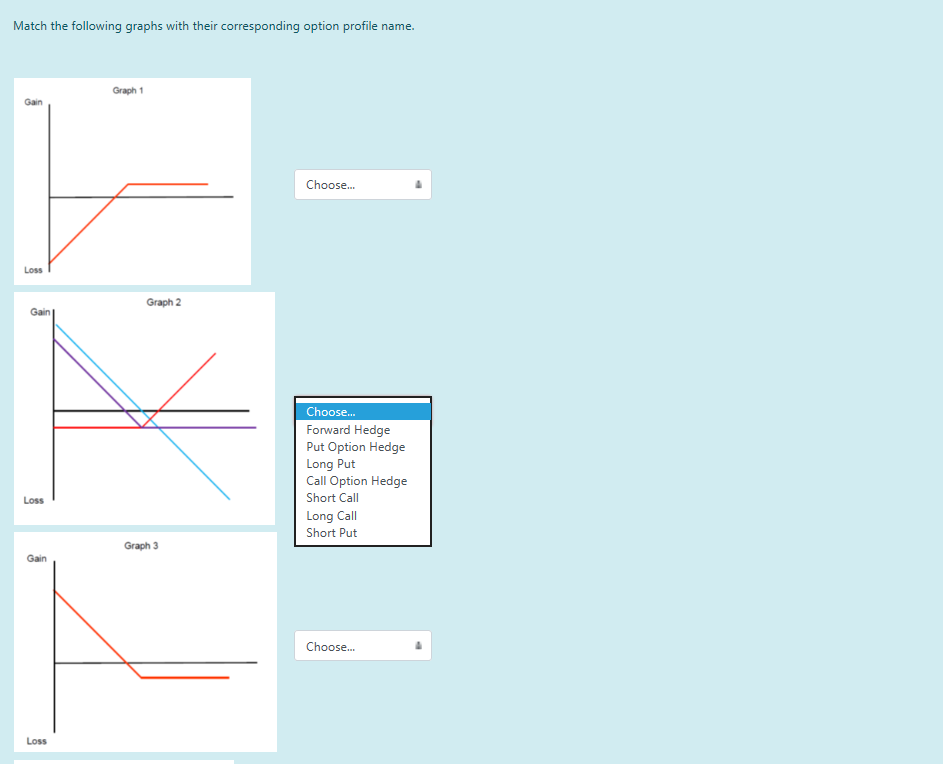

USES OF OPTIONS: HEDGING Spot price risks: 1.Risk of spot price FALL –Person/firm committed to sell good (output) in the future 2.Risk of spot price RISE. - ppt download

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-06_2-6d3800fb5e354a6c9f884cb48085f842.png)

![Long Put Strategy Guide [Setup, Entry, Adjustments, Exit] Long Put Strategy Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607eeaf50be8ec71ff3d23aa_Long%20Put%20-%20Adjust%20to%20Long%20Straddle.png)

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

![Short Put Strategy Guide [Setup, Entry, Adjustments, Exit] Short Put Strategy Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/60809724fcdd3beea94d7c07_Short%20Put%20-%20Adjust%20to%20Short%20Straddle.png)